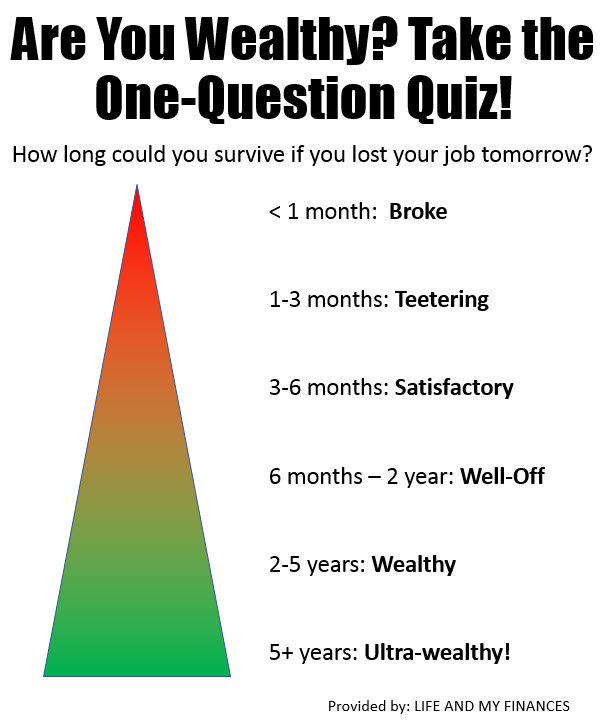

Here’s a stealth wealth/net worth revealing challenge if ever there is one:

If you were to lose your job tomorrow, how long can you survive?

I came across this from J. Money of BudgetsAreSexy, who picked it up from LifeAndMyFinances.

This is a question that will be recognizable to those who work part time or are on perpetual “casual” employment contracts that get renewed on a term-to-term basis. I realize that I’ve been in this situation almost my entire working life: from the media job that subsists on getting projects lined up one after the other, to the government job that needs you to write a “renewal” letter at the end of each year, to the part time or adjunct academy circuit where people juggle at least two jobs at a time.

Two words that are the source of unspeakable horrors: Lean years. This is something we all have to live with for the next 3 years at least. Where I’m at, there’s nothing that makes you more aware of your precarious work situation when the end of the term comes and you have not yet received your assignment or “load” for the next and will only learn about it on the day before you start. And even then, it’ll be a surprise as to how much load you’ll be carrying. In some places it’s not so bad, where planning starts in the middle of the term and you more or less know if you have to take on more gigs.

I think if you throw this question at most part timers, there’s going to be much agony and much scrambling to apply in other places.

As for me, if I got called to the boss’ office and got told that there’s nothing for me come January, I don’t think I’ll panic.

Yet.

There are several things working to my advantage:

- I’m single and have no kids.

- I don’t pay rent. But I pay for household bills and expenses.

- I’m relatively healthy.

- I live frugally.

- I’ve built an emergency fund.

This last item I owe to a series of lucky breaks:

Some years back, when all the talk about K-12 came up, the Posh School designed a plan where they will “front load” all the part timers—meaning give every one of their contractuals the full allowable work load as a way to save up for the lean years. That meant I had a few terms where I was getting double the usual work I had.

Then I discovered that they’ve been computing my pay rate wrong. The accounting office used the entry level rate where I should be at another rate. So I received wage adjustments for a full year’s work. The bad part was that accounting gave it at one go so that’s a whopping 30%++ in taxes. That’s when I put that money in a brokerage account.

Then I started at the Big School which allowed me to rack up some more savings. Then this year I let go of that original Posh School.

But I recognize how lucky I was about those “front loading” terms and the miscalculation of wages which lead to me accidentally building an emergency fund.

Plus, my entire work life I’ve been used to this boom and bust cycle. After getting paid for a project, I tend to hoard it because I know that the next pay cycle is going to be a long ways down the road. Setting up a new project or getting a new gig takes time, and one must allocate her resources a bit more sparingly.

To answer the question, just how long will I last if I lost my job tomorrow?

|

| From Budgets Are Sexy |

Provided that I maintain my frugal ways and don’t have to pay rent, then I can live 6-9 months on emergency funds.

If it’s really really tough and I have to rely on my entire net worth, then it could be upwards of three years.

It's not much. As someone who knows what it's like to be really poor, it is a whole lot better.

I suppose my only regret is that no one told me that money shouldn't really be sitting in a savings account. Otherwise, maybe I have a shot at joining the super elite ultra-wealthy category. But as they say, there's no better time to start investing than today.

It's not much. As someone who knows what it's like to be really poor, it is a whole lot better.

I suppose my only regret is that no one told me that money shouldn't really be sitting in a savings account. Otherwise, maybe I have a shot at joining the super elite ultra-wealthy category. But as they say, there's no better time to start investing than today.

From those other blogs, that qualifies me under the “wealthy” category, although I can assure me that I don’t really feel wealthy. I don’t really own a lot of material things, save for a few gadgets like a laptop, a tablet and a phone—things I need to work. Other than that, I don’t really “own” anything. If a thief broke into my house, I think they’ll be very disappointed to see boxes of books, some clothes, a ton of paper and not much else.

Doing this exercise somehow reassures me that I don’t have to run and pimp myself out as the world's worst hooker, or sell a kidney or two. But still, in these highly precarious times, we all need to have a Plan C. I’m already on my Plan B so I need a back up on my back up plan.

No comments:

Post a Comment